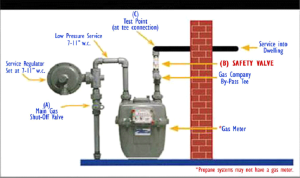

Manually turning off the gas service shutoff valve is the most common method to stop the flow of gas serving a building, or part of a building, in case of an emergency. Gas service shutoff valves are installed by PG&E at all gas meter locations or outside locations if the meter is not accessible from the outside.

Keep a 12 to 15-inch adjustable pipe wrench or Crescent-type wrench available to close the valve in case of an emergency. Earthquake wrenches with fixed openings may not fit a particular valve, so an adjustable type is best. To minimize the possibility of unauthorized operation of the valve, wrenches should be located nearby, but not at the gas meter location.

Shut off the gas service shutoff valve only if you smell gas, hear gas escaping, see a broken gas line, or if you suspect a gas leak.

To shut off the gas, rotate the valve a quarter turn in either direction; the valve is closed when the tang (the part you put the wrench on) is crosswise to the pipe.

In addition, most gas appliances have a gas shutoff valve located near the appliance that lets you turn off the gas to that appliance only. Know which of your appliances use gas, and where the appliance gas shutoff valves are located. In some cases, turning off the gas at the appliances shutoff valve will suffice.

Check out this You Tube video